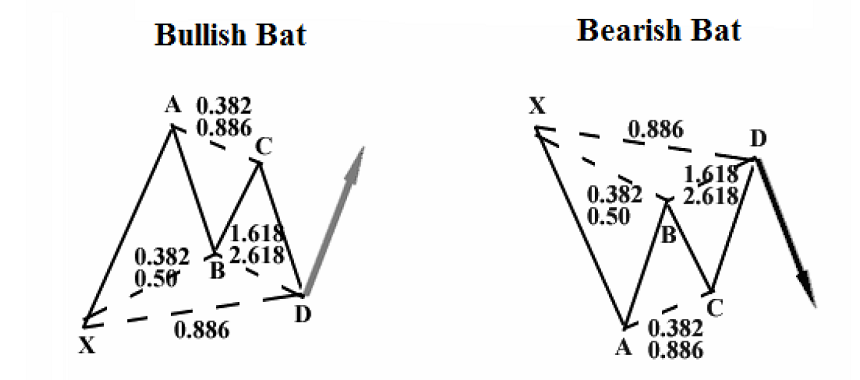

The Bat pattern is a variation of the harmonic pattern Gartley pattern. The outlines of these patterns are the same, the difference is in Fibonacci ratios that define the positions of the main points.

Let’s have a look at the parameters of a Bat pattern:

- Point B is at the 38.2-50% retracement of XA.

- Point C can be at the 38.2%-88.6% retracement of AB.

- Point D can be found at the 161.8%-261.8% extension of AB or at the 88.6% retracement of XA.

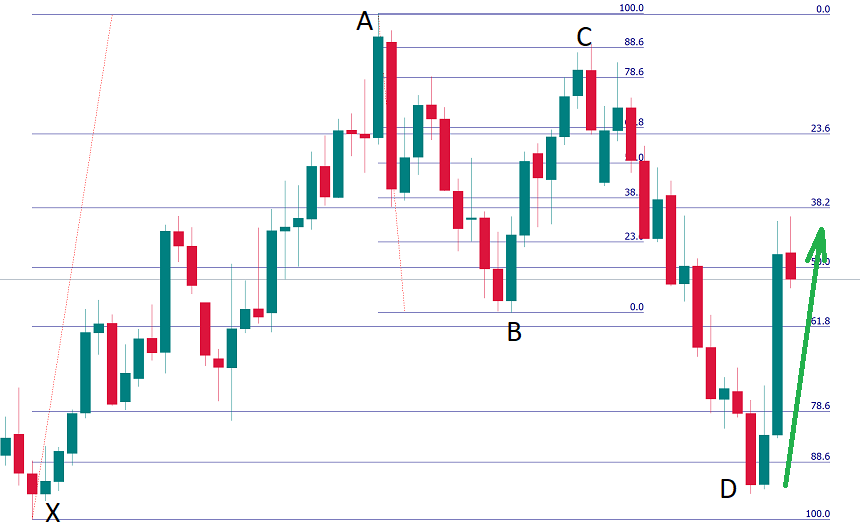

How to trade Bat pattern

- The entry is at the point D. As usual, a confirmation of the market’s reversal here is necessary.

- Take Profit may be at 61.8% of CD (TP1), 127.2% of CD (TP2), and/or the projection of XA from D (TP3).

- Put a Stop Loss in line with your rules of risk management.

Let's have a look at the example of the bullish Bat pattern on the chart.

You can see that the point B is at about the 61.8% retracement of XA, the point C is at the 88.6% retracement of AB, while the point D is near the 88.6% retracement of XA. The Fibo ratios are not exactly the same as at the scheme, but they are close enough. Notice that a "harami" candlestick pattern was formed at the point D confirming the price's reversal to the upside.

0 commentaires:

Enregistrer un commentaire