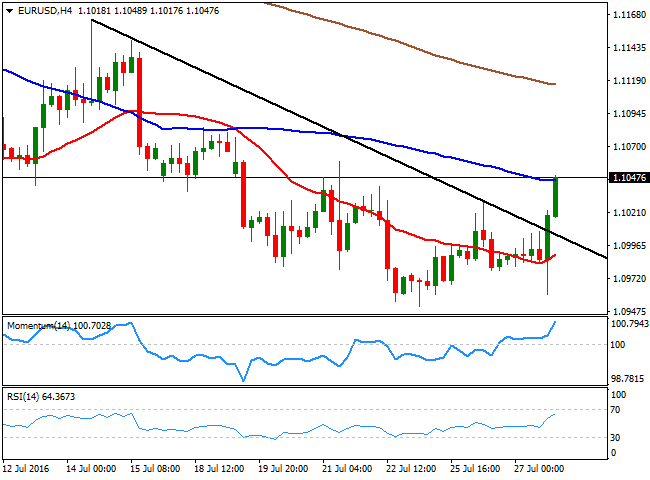

EUR/USD Current price: 1.1049

The key event today was meant to be the July FOMC monetary policy meeting in the US, but upcoming stimulus programs in Japan are also to be blamed for what happened this Wednesday. The day started with news pointing for a more than 28 trillion yen fiscal stimulus package, and the emission of 50-year bonds by the Japanese government. The Minister of Finance, Taro Aso, denied this last one, but Abe confirmed the first, triggering wild swings during the Asian session that ended up benefiting the greenback. The market entered then wait-and-see mode ahead of the US Central Bank decision, which left rates unchanged, but issued an upbeat assessment of economic conditions, remarking that the "near term risk to the economic outlook have diminished." Investors rushed to buy the greenback after the announcement, but the greenback reversed gains as markets still don't believe a September higher is likely.

The EUR/USD pair initially fell to 1.0960, but then surged to 1.1050, holding above the 1.1000 level by the end of the US session, but trapped within its early week range. The limited upward momentum has sent the price above a short term descendant trend line coming from July 14th high at 1.1164, but given that it's still struggling to overcome the 1.1050/60 region, further gains seem unlikely. In the 4 hours chart, the price is above its 20 SMA, but below the 100 SMA, this last around 1.1050, while the technical indicators head modestly higher above their mid-lines, with no certain upward strength. The pair maintains a neutral-to-bearish stance, although a break below 1.0910 is required to confirm a new leg lower, while above the 1.1100 figure, the pair can extend up to the 1.1190 level, the post-Brexit high.

Support levels: 1.0990 1.0955 1.0910

Resistance levels: 1.1060 1.1100 1.1145

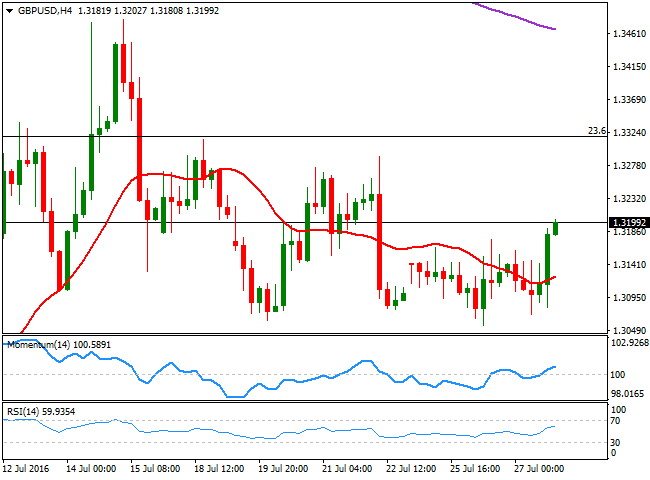

GBP/USD Current price: 1.3200

The British Pound was among the most benefited following FED's announcement, as the GBP/USD pair recovered above the 1.3200 level, reaching a fresh weekly high of 1.3229. The Sterling remained muted early Europe after the release of a better-than-expected Q2 GDP, showing that the economy grew by 0.6% in the three months to June, against previous 0.4%. Yearly basis, the reading was also upbeat, up to 2.2% against previous 2.0%. Still, data reflected a pre-referendum scenario, and it won't be until the release of the Q3 GDP that the market will have a clearer picture of the UK economic growth. Now trading near the mentioned high, the short term technical picture is bullish, as in the 1 hour chart, the technical indicators head sharply higher near overbought levels, whilst the 20 SMA is turning modestly higher far below the current level, as a reaction to the over 100 pips advance. In the 4 hours chart, the price has settled and advanced above a still flat 20 SMA, while the RSI indicator accelerated higher, now around 63, but the Momentum indicator holds flat within neutral territory. The pair can extend its advance up to 1.3220, the 23.6% retracement of the post-Brexit slump, although selling interest around the level is expected to contain the advance.

Support levels: 1.3165 1.3120 1.3070

Resistance levels: 1.3230 1.3280 1.3320

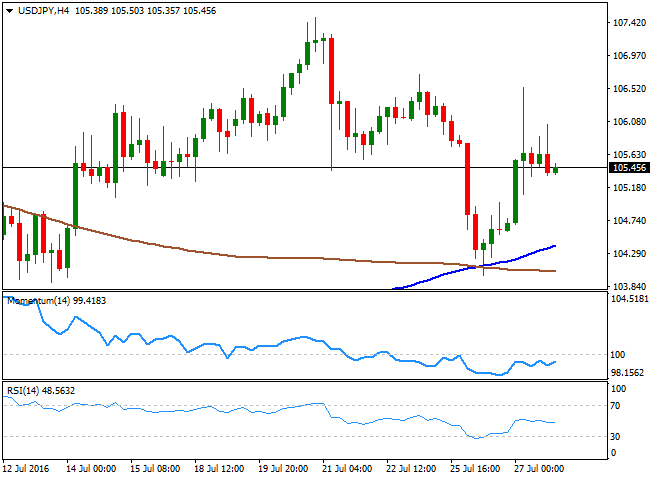

USD/JPY Current price: 105.45

The USD/JPY pair settled around 105.50 after the wild swings suffered early Wednesday, showing a limited reaction to FED's announcement, as the pair is being driven mostly by the many twists and turns of Japanese authorities. The YEN plummeted amid stimulus package details were unveiled by PM Abe, who agreed a fiscal stimulus package of over JPY 28trn, to be announced early August. At the same time, there rumors making the rounds of a plan to issue 50-year JGB plan in the coming days, later denied by FM Taro Aso. The pair jumped to a daily high of 106.53, before retreating, with the upside being limited later on the day by poor US data, as June Durable Goods Orders came in much worse-than-expected, falling by 4.0%. The pair will likely enter now in wait-and-see mode ahead of the upcoming BOJ's meeting early Friday, but the short term picture favors the downside, as in the 1 hour chart, the price was unable to settle above its moving averages, whilst the technical indicators head south around their mid-lines. In the 4 hours chart, the price is holding above its 100 and 200 SMAs, but the technical indicators hold flat within negative territory, supporting the case for further consolidation ahead.

Support levels: 105.10 104.60 104.20

Resistance levels: 106.10 106.60 107.00

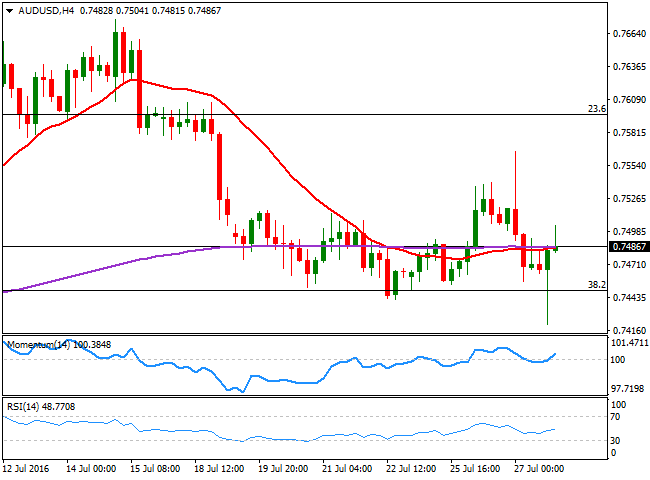

AUD/USD Current price: 0.7487

The AUD/USD pair closed the day in the red below the 0.7500 level, suggesting bulls are starting to give up on the Aussie. The release of Q2 inflation data earlier in the day diminished chances of a RBA rate cut in the near term, as trimmed CPI in the quarter came in at 1.7%, beating expectations of 1.5%. The news sent the pair briefly higher up to 0.7653, but the fact that pair was unable to hold on to gains supports the case for some further declines ahead. Dollar's temporal strength post-FED sent the pair down to 0.7420, adding to the bearish case. Short term, however, technical indicators recovered from near oversold readings in the 1 hour chart, and the price is above a bearish 20 SMA, while the price is also holding above 0.7450, a major Fibonacci support, limiting the downward risk. In the 4 hours chart, the price is hovering around the 20 SMA and the 200 EMA, both horizontals and around 0.7485, while the technical indicators head modestly higher above their mid-lines, but with limited upward strength.

Support levels: 0.7450 0.7410 0.7330

Resistance levels: 0.7530 0.7580 0.7625

0 commentaires:

Enregistrer un commentaire