With some experience, a trader will understand that it’s possible to improve his/her trading results not only through market analysis but also with the help of other techniques. In particular, it’s possible to manage the size of an open position in order to limit risks and increase profit. Are you interested? Then let’s get into it.

Scaling in a trade

Scaling in implies increasing a trade that already shows a profit. It’s very useful in times when you think that a new trend may start but you aren’t really sure and want to reduce your risk exposure. This approach is also sometimes referred to as “pyramiding”.

Scaling in will reduce your risk only if you open a smaller trade than you usually do according to your money management rules. In other words, scaling in implies entering a trade in pieces. You will also need to choose in advance the levels at which you will add to your position.

Notice that you can only add to a position by opening a new order at the current market price. So, while we logically see it as “adding to a trade”, scaling in actually means that you make multiple positions in the same direction at different predetermined price levels (once the price arrives at these levels).

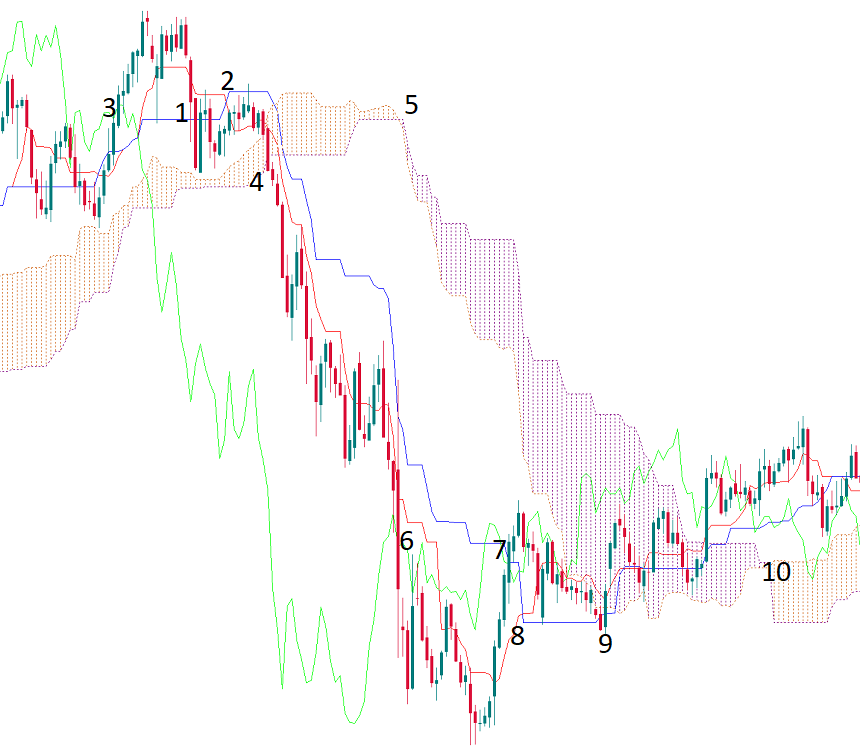

Example

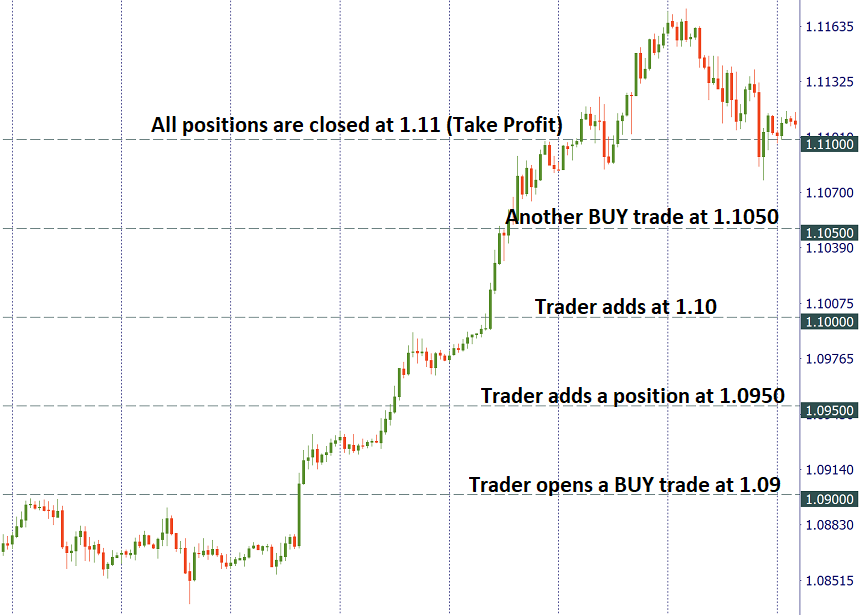

Let’s imagine that you wanted to buy EUR/USD at 1.09 targeting 1.11 but didn’t feel sure about this trade. To reduce your risks, you decided to scale in: you broke your usual trade size (for example, 1 lot) in 4 parts (0.25 lots each) and defined levels at which you would open new buy trades (in this case, the trade was increased simply every 50 pips).

You can use different tools to determine the levels at which you will add to your trade: Fibonacci, pivot points, key previous highs, and lows, etc.

Scaling in protects you in case of unfortunate events. If you opened the entire 1-lot buy trade at 1.09 and then the market reversed down, your loss would have been 4 times bigger than the loss you would have if you opened a 0.25-lot trade. At the same time, if you didn’t open this trade at all and the price did really go up, you would have missed a chance to join a trend at the earliest stage.

It would be wise to trail your stop loss after the price each time you add a new position so that you never risk more than you have decided to risk in one trade.

Notice that scaling in is not recommended for range-bound markets or periods when the price tends to make sharp movements back and forth. Scaling in is more suitable for trend and breakout trading.

All in all, scaling in helps to reduce the risks while increasing profit. This is a very good combo from the risk management point of view. Still, try not to get carried away: it’s not wise to scale in every profitable trade. Remember that the decision to scale in has to be made in advance before you open a trade. If you didn’t think that through or considered that it could be necessary at the time, then treat such trade like a usual one and don’t try to add to it.

Scaling out of a trade

Scaling out implies partial closing of a profitable trade. Why would anyone need to close a trade that’s showing a profit?

Imagine that you ride the trend for some time. The longer the trend unfolds, the greater the risk that it will end. At the same time, it’s in your interest to ride the trend as long as possible before the market reverses.

This is where scaling out will help: by closing a part of your position, you thus reduce your risks in case of a reversal. At the same point, you retain the opportunity to keep the trade open and if the trend continues you will gain more than you would have if you closed the trade earlier.

The good option is to combine scaling out of a trade with moving a Stop Loss order to breakeven point. It’s better to explain this on an example.

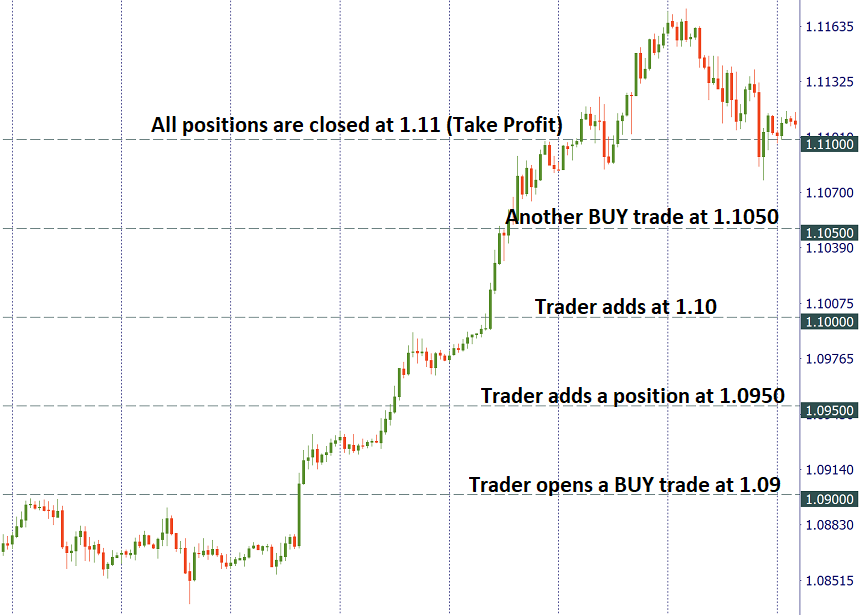

Example

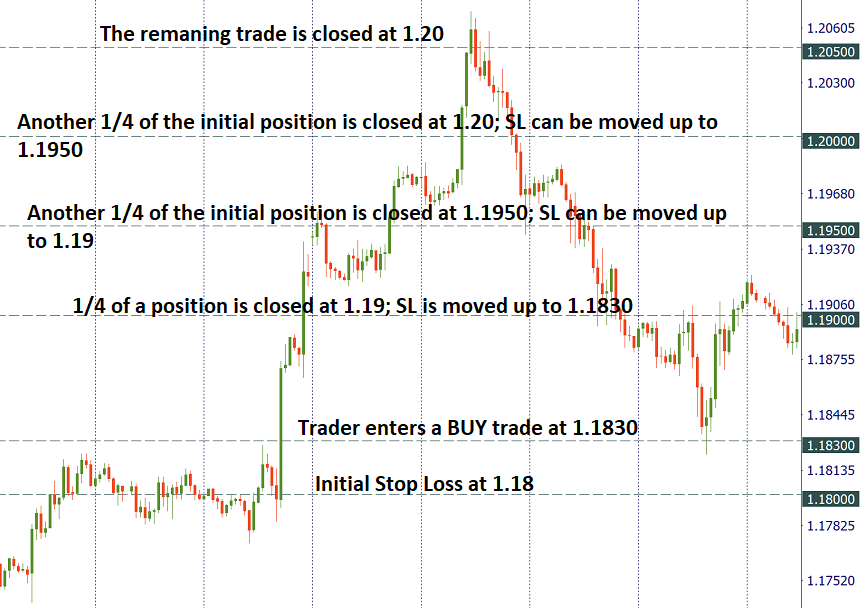

You opened a buy trade at 1.1830 targeting a move up at least to the 1.1900 area with a Stop Loss at 1.1800. When the price reached 1.1900 it continued going up. That gave you an idea to scale out of this trade. You decided to close ¼ of the position and move your stop loss to the breakeven point (1.1830). This way if the market didn’t continue going up you would secure a small gain and lost nothing if the SL got hit.

However, it the price went up in line with your expectations, you would have a chance to take profit for another ¼ of the position at 1.1950 and then at 1.20 before the final part of your trade would be closed at 1.2050. Thus, you would have traded a big trend without risking anything after your SL was moved up to the no-loss level.

Scaling out can be used as you trade trends or breakouts when the price is moving fast in one direction and you are not sure whether the volatility will keep propelling the market or make it reverse. There’s no point to scale out if you trade in a range.

In order to partially close a trade in MT4, go to the ‘Trade’ tab in the ‘Terminal’. Double click on the trade you wish to modify. An order window will appear. In ‘Volume’, type in the amount you wish to close or select from the drop-down menu. Click the yellow ‘Close #..’ button. Once done, you will receive a confirmation for the portion closed.

These were the safe and efficient methods of managing your position size. Next, we will explain the techniques that are not so safe and thus can lead to bad outcomes: forewarned is forearmed.

Averaging down and martingale

Averaging down means increasing a losing trade. Some traders do that in hope that the price will reverse and adding to the trade will allow them to enter the market at better levels. Beware that losses always make traders feel the strain of stress. That can cloud judgment and lead to all kinds of bad decisions. We recommend you to stay away from these tactics and increase only winning trades.

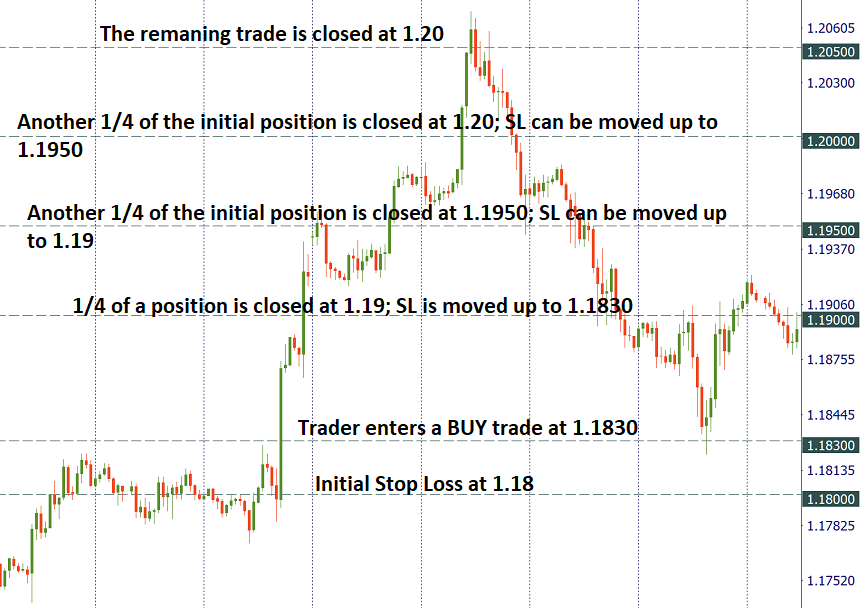

Martingale is a notorious type of cost-averaging strategies that came from the world of gambling. The core idea is very simple: you double your position size after every losing trade so that you recoup losses and more if a winning trade occurs.

The strategy is supposed to be suitable for systems where the chance of winning is equal to the chance of losing — for example, when you toss a coin. However, if you decide to use this strategy for currency trading, your risk exposure will actually be very high.

For instance, if you make wrong bets during a trend, the martingale approach can wipe up your entire deposit. Imagine that you have $100. If you lose $5 in your first trade, it will take 4 losses in a row (-$5, -$10, -$20, -$40) for you to lose your deposit. As you will have only $25 left after such trades, you won’t be able to continue martingale and attempt to finally make the winning trade that will make up for the lost money. Add here the fact that if you use big leverage, even small price movements against you will let you bear big losses. As a result, martingale can be used only by very experienced and confident traders who have a large amount of capital.